Being a first-time homebuyer is one of the most exciting things you can experience.

You’ve likely spent endless hours daydreaming of the possibilities – and now those dreams are about to become your reality.

But before you jump in head-first into the waters of real estate, there are several things you should know.

Here are some tips and tricks for buying your first home.

Hold the House-Hunt: First Things First

Having begun your search for the perfect house online, you’re probably chomping at the bit to tour houses in person.

However, there are several reasons you should put the house-hunt on hold until you’ve got all your essentials in order and are armed with true purchasing power.

One of the risks you face when you find the house first before you’ve got the financing is that you may not qualify for the home mortgage loan, or the application process may take too long, allowing other buyers to swoop in on your prize.

Preparing Financially for Your Home Mortgage Loan

When you apply for a home mortgage loan, you’re bringing to the table a twenty percent deposit on the home you’re buying. A twenty percent deposit on a $300,000 home is $60,000, which is a healthy chunk of change.

In most cases, the lenders do not roll your down payment into your home mortgage loan, although it isn’t unheard of.

There may also be special loans and programs that may reduce the amount of your down payment.

However, the balance due you’ll pay out-of-pocket. But that’s not all you’ll be paying with your purchase.

When you submit an offer to a seller, you’re required to put down an earnest money deposit to the tune of about one percent of the home’s purchase price. That means that an earnest money deposit on a $300,000 home is $3,000.

That money, also cash-out-of-pocket, doesn’t go to the seller but is held in an escrow account and applied to your purchase at closing. It does, however, show the buyer that you’re committed to buying the property.

Then there are closing costs. “Closing costs” is a term used to encompass all of the charges and fees associated with your home purchase. Examples of closing costs include lender fees, appraisals, inspections, surveys, escrow agents, title checks and transfers, and more.

Closing costs run between two and seven percent of the purchase price of your new house. If you average at five percent, your closing costs will equate to an additional $15,000. Like your down payment, closing costs are not encompassed in your home mortgage loan, so you’ll be paying cash at closing.

In total, to purchase a $300,000 house, you’ll need to come to the table with an estimated $78,000.

Credit Score, Debt-to-Income Ratio, and Paperwork

Before you apply for a home mortgage loan, it’s crucial that you do not finance any major purchases for at least a year or two. Financing cars, furniture, vacations, or maxing out credit cards could cause you to be denied for your home mortgage loan.

If you have any outstanding debts, collections, or negative marks on your credit report, rectify those before applying for your home mortgage loan.

It’s also best if you don’t move or change employment two years prior to your purchase. Lenders look for stability, consistency, and reliability.

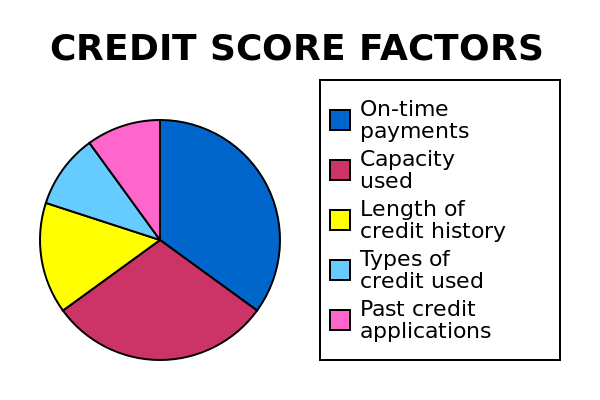

When you apply for your loan, your lender will investigate your credit report, assessing your credit score, and measuring your debt-to-income ratio. To qualify, you need a credit score of no less than 620, but a score of 720 or higher may earn you lower interest rates.

Your debt-to-income ratio is your monthly expenses divided by your monthly income. Your debt-to-income ratio should be no higher than 43 percent, but a ratio of 36 percent or lower is best. You can improve your DTI by paying down debts.

Be prepared to provide a heaping amount of documentation. You’ll have to turn in bank statements, pay stubs, loan documents, credit card statements, student loans, investments, and any other proof of your income and expenses.

The more organized you are with your documentation, the faster you’ll move through the application process.

Pre-Approval for your Home Mortgage Loan

There are several reasons you should get approved for your home mortgage loan before you start looking for your dream home.

Pre-qualification and pre-approval are not the same. Pre-qualification is an informal estimate of whether or not you may qualify. Pre-approval, on the other hand, means you’ve already gone through the application process and are ready to buy.

First, you need to know how much you qualify for so that you shop within your price point, considering your down payment, earnest money deposit, and closing costs.

Second, when you find a house you like, you’re immediately ready to buy; you won’t have to wait for the lengthy application process, wondering if you’ll be approved.

Next, pre-approval may incentivize a seller to choose your offer over a competing offer. Even if another buyer offers a higher price, if they’re not pre-qualified, they can’t put their money where their mouth is – and the seller knows this.

Furthermore, a seller may be motivated to move quickly, wanting to avoid the time it takes for a buyer to apply for a home mortgage loan.

Don’t Attach to a House to Soon

Submitting your offer and waiting for a seller’s response can be agonizing. It makes sense, then, to celebrate the moment when your agent tells you the seller accepted your offer. But don’t get too excited just yet. There’s more to go through.

Before you can buy the house, your lender requires an appraisal, inspection, and possibly surveys. There’s also a title check to make sure the house can be legally sold. At any point during these steps, the contract may fall through.

If the house doesn’t appraise for what it’s worth, or if problems are revealed during the inspection, you have the options to negotiate a lower price, require the seller to make repairs, or, in the worst-case scenario, you have the legal right to withdraw your offer. But once those processes are complete, the deal is locked in, and you’re on your way to getting your keys.

Finding the Right Real Estate Agent

One of the best things you can do to ease and expedite your home buying experience is to work with a highly qualified professional real estate agent who specializes in the kind of property you want to buy.

Your agent does more than show you houses that match your price point and your wish list.

Your agent will first help you understand the current real estate market and what home values are in the location you’d like to live. This is where you may have to modify your wish list or your location so that your house fits in your budget.

Your agent also helps you know what potential pitfalls to watch for in properties and helps you draft a competitive offer when you’re ready to bid on a house. If necessary, your agent negotiates with the seller’s agent to arrange a win/win deal for you and the seller both.

Finally, your agent walks you through the closing process, helping you understand each step along the way – and will be the first to congratulate you on the purchase of your first house.

JJK Home Network is the best source of information about the local community and real estate topics. Give JJK Home Network a call at 314-258-1296 or 618-691-0547 to learn more about local areas, discuss selling a house, or tour available homes for sale.